House depreciation calculator

A 250000 P 200000 n 5. The value of the home after n years A P 1 R100 n Lets suppose that the.

How To Prepare Depreciation Schedule In Excel Youtube

There are many variables which can affect an items life expectancy that should be taken into consideration.

. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click Calculate. SYD depreciation Method Yearly Depreciation Value remaining lifespan SYD x. The Washington Brown a property.

Depreciation deduction for her home office in 2019 would be. Real Estate Property Depreciation Calculator Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation. Depreciation recapture tax rates.

Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. Depreciation Amount Asset Value x Annual Percentage Balance. This can be extended to 500000 if you file a joint tax return with your spouse.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. It provides a couple different methods of depreciation. To be more specific you can exclude up to 250000 in capital gains when you sell your house.

The property depreciation calculator shows your property depreciation schedule year by year the schedule includes Beginning Book Value Depreciation Percent Depreciation Amount. Divide the net return by the initial cost of the investment. A depreciation calculator is merely an accounting tool that helps investors save money by claiming the wear and tear of a property on their tax return.

A 250000 P 200000 n 5. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the beginning of the year 3.

For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is. 270000 x 1605 43335. First one can choose the.

Calculate the average annual percentage rate of appreciation. Start by subtracting the initial value of the investment from the final value. Accelerated depreciation for qualified Indian reservation property.

On the same date her property had an FMV of 180000 of which 15000 was for the land and 165000 was for the. This calculation gives you the net return. The calculator should be used as a general guide only.

For the first year youll depreciate 1667 or 165033 99000 x 1667. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses As for the residence itself. The calculator should be used as a general guide only.

That means the total deprecation for house for year 2019 equals. There are many variables which can affect an items life expectancy that should be taken into consideration. Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your.

Macrs Depreciation Calculator With Formula Nerd Counter

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

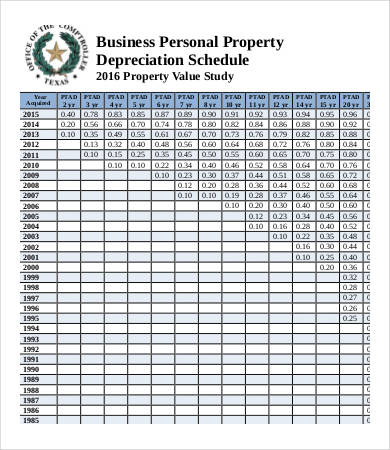

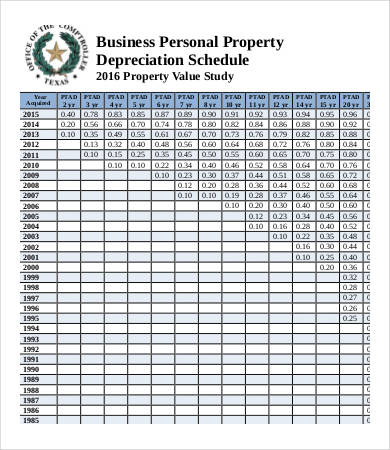

Depreciation Schedule Templates 7 Free Word Excel Pdf Documents Download Free Premium Templates

Section 179 For Small Businesses 2021 Shared Economy Tax

Straight Line Depreciation Calculator And Definition Retipster

A Guide To Property Depreciation And How Much You Can Save

How To Use Rental Property Depreciation To Your Advantage

Rental Property Depreciation Rules Schedule Recapture

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Formula Calculate Depreciation Expense

Free Macrs Depreciation Calculator For Excel

What Is A Quantity Surveyor What Do They Do And How Can They Help You 2022 Guide Duo Tax Quantity Surveyors

Units Of Activity Depreciation Calculator Double Entry Bookkeeping

Depreciation And Off The Plan Properties Bmt Insider

Free Construction Cost Calculator Duo Tax Quantity Surveyors

Appreciation Depreciation Calculator Salecalc Com